Investing in precious metals has become a smart choice for many people. When you buy gold bullion bars online or buy rare silver coins online, you’re adding real value to your portfolio. These metals hold their worth even when the stock market goes down. They’ve been valuable for thousands of years, and that won’t change anytime soon.

Many investors start with gold bars because they’re easy to store and track. Others prefer rare silver coins for their collectible value. Both options have benefits. The key is finding a trusted dealer who offers fair prices and genuine products.

The online precious metals market has grown significantly. You can now shop from home and compare prices across different dealers. But with this convenience comes responsibility. You need to know what to look for and which dealers you can trust.

Understanding Gold Bullion Bars: What You Need to Know

Gold bullion bars are pure gold formed into rectangular shapes. They come in different sizes, from one gram to 400 ounces. Most individual investors choose bars between one ounce and ten ounces. These sizes are easier to store and sell when needed.

When you buy gold bullion bars online, you’re buying gold based on its weight and purity. The most common purity level is 99.99% pure gold, also called 24-karat gold. Each bar has markings that show its weight, purity, and manufacturer. These details matter because they determine the bar’s value.

Prices change daily based on the spot price of gold. This is the current market price per ounce. Dealers add a premium on top of this price. The premium covers their costs and profit. Larger bars usually have lower premiums per ounce than smaller bars.

Gold bars are a straightforward investment. You’re not paying extra for artistic design or rarity. You’re simply buying gold. This makes them perfect for people who want to own physical gold without complications.

The Appeal of Rare Silver Coins: More Than Just Metal

Silver coins offer something different than gold bars. When you buy rare silver coins online, you’re getting both precious metal value and collectible value. Some coins are worth much more than their silver content because of their rarity or historical significance.

Rare coins come from different time periods and countries. American Silver Eagles, Morgan Dollars, and Walking Liberty Half Dollars are popular choices. Each coin tells a story. Collectors love the history behind these pieces.

The condition of a coin matters greatly. Coins are graded on a scale from 1 to 70. Higher grades mean better condition and higher value. A coin in perfect condition can be worth ten times more than the same coin in poor condition.

Silver coins are also more affordable than gold for new investors. You can start with a few hundred dollars instead of several thousand. This makes them accessible to more people. Many collectors start with silver and later add gold to their holdings.

Why Choose Park Avenue Numismatics for Your Purchase

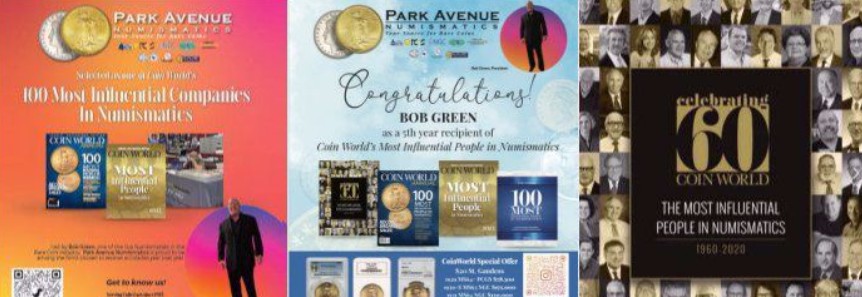

Park Avenue Numismatics brings over 30 years of experience in buying and selling rare coins and precious metals. They prioritize customer privacy and use the latest online security processing to keep your orders safe and private.

Finding a trustworthy dealer is the most important step. You’re spending serious money, so you need a company with a solid reputation. Park Avenue Numismatics has served thousands of customers since their founding. They understand both the investment side and the collector side of precious metals.

Their team knows the market inside and out. They can answer your questions about gold purity, coin grading, and current market conditions. This knowledge helps you make better buying decisions. You’re not just getting products. You’re getting expertise.

The company offers both gold bullion bars and rare silver coins. This gives you options under one roof. You can build a diverse precious metals portfolio without dealing with multiple dealers. Their selection includes popular items and harder-to-find pieces.

How to Safely Buy Gold Bullion Bars Online

Start by researching current gold prices. Check the spot price on financial websites. This gives you a baseline for comparison. Then look at dealer premiums. A fair premium ranges from 3% to 8% over spot price for standard bars.

Verify the dealer’s credentials. Look for membership in professional organizations like the Professional Numismatists Guild. Read customer reviews on independent websites. Check their business rating with consumer protection agencies.

When you buy gold bullion bars online, ask about authentication. Reputable dealers provide certificates of authenticity. These documents prove your gold is genuine. They include details about weight, purity, and origin.

Understand the shipping process. Gold is valuable and heavy. Dealers should use insured shipping with signature confirmation. Some offer to store your gold in secure vaults instead of shipping it. This option works well if you’re buying large quantities.

Payment methods matter too. Bank wires and checks are common for large purchases. Some dealers accept credit cards but charge higher premiums to cover processing fees. Choose the method that balances convenience with cost.

Tips for Buying Rare Silver Coins Online Successfully

Education comes first with rare coins. Learn about the coins you want to buy. Study their history, typical grades, and fair market values. Resources like the Red Book of United States Coins provide valuable information.

Buy certified coins when possible. Third-party grading services like PCGS and NGC authenticate and grade coins. They seal them in protective holders. This certification adds credibility and makes coins easier to resell later.

When you buy rare silver coins online, examine the photos carefully. Dealers should provide clear, detailed images. Look at both sides of the coin. Check for wear, scratches, or cleaning marks. These factors affect value significantly.

Start small if you’re new to collecting. Buy one or two coins first. This lets you test the dealer’s service and product quality. Once you’re comfortable, you can make larger purchases.

Watch for sales and special offers. Dealers sometimes discount specific coins to move inventory. You can find good deals if you’re patient. But don’t buy something just because it’s on sale. Make sure it fits your collection goals.

Comparing Costs: Gold Bars vs. Silver Coins

Gold bars require more upfront capital. A one-ounce gold bar costs around $2,000 to $2,500 depending on current prices. But the premium per ounce is lower. You’re getting close to pure metal value.

Silver coins are more affordable. A silver coin might cost $30 to $100 depending on its rarity and condition. You can start collecting with less money. This makes silver accessible to younger investors and those with smaller budgets.

Storage costs differ too. Gold takes up less space because it’s more valuable per ounce. You can store significant wealth in a small safe. Silver requires more room for the same dollar value.

Both metals have liquidity. You can sell gold bars or silver coins fairly easily. Gold might be slightly easier to sell quickly because it’s more universally recognized. But rare silver coins often attract passionate collectors willing to pay fair prices.

Consider your investment timeline. Gold bars work well for long-term wealth preservation. Silver coins offer both investment potential and hobby enjoyment. Many people own both for a balanced approach.

Red Flags to Avoid When Shopping Online

Prices that seem too good are usually problems. If a dealer offers gold for 20% below spot price, something’s wrong. They might be selling fake products or running a scam. Stick with dealers who price fairly based on market rates.

Avoid dealers who pressure you to buy quickly. Legitimate companies give you time to make decisions. High-pressure tactics are warning signs. Take your time and don’t let anyone rush you.

Check the return policy carefully. Good dealers allow returns within a reasonable timeframe. You should be able to send back products if they don’t match the description. Avoid dealers with no-return policies.

Be cautious about storage programs that seem complicated. Some dealers push expensive storage plans you don’t need. If you’re buying small quantities, storing metals at home in a safe works fine. Large quantities might justify professional storage, but understand all fees first.

Research the dealer’s physical location. Companies with real addresses and phone numbers are more trustworthy. Park Avenue Numismatics operates from Miami, Florida, with a toll-free number for customer service. This transparency builds confidence.

Making Your First Purchase: A Step-by-Step Process

First, decide what you want to buy. Are you interested in gold bars, silver coins, or both? Set a budget that won’t strain your finances. Precious metals should be part of your overall financial plan, not your entire savings.

Visit the dealer’s website. Browse their inventory and read product descriptions. Look for items that match your goals. Note the prices and specifications. Compare similar items to understand the market.

Contact customer service with any questions. Test their responsiveness and knowledge. Good dealers answer questions thoroughly and professionally. This interaction tells you a lot about the company. You can reach out to https://www.parkavenumis.com for personalized assistance.

Place your order when you’re ready. Follow the checkout process carefully. Provide accurate shipping information. Double-check everything before submitting payment.

Wait for delivery confirmation. Track your shipment if possible. Inspect your purchase immediately upon arrival. Verify it matches the description. If there’s a problem, contact the dealer right away.

Long-Term Value: What History Teaches Us

Gold has maintained value for over 5,000 years. Ancient civilizations prized it. Modern investors still seek it. This track record speaks volumes. Gold protects wealth during economic uncertainty.

Silver has industrial uses beyond investment. It’s used in electronics, solar panels, and medical equipment. This practical demand supports its price. When you buy rare silver coins online, you’re getting both industrial metal and collectible value.

Both metals have outpaced inflation over long periods. They don’t always go up steadily. Prices fluctuate based on economic conditions. But over decades, they’ve preserved purchasing power better than paper currency.

Past performance doesn’t guarantee future results. No investment is completely safe. However, precious metals have proven resilient through wars, financial crises, and political upheavals. This history provides reasonable confidence for the future.

Final Thoughts: Building Your Precious Metals Portfolio

Buying gold and silver online offers convenience and choice. You can shop from home and compare options easily. But success requires research and caution. Know what you’re buying. Understand fair pricing. Choose reputable dealers.

Park Avenue Numismatics provides a trustworthy option for both gold bullion bars and rare silver coins. Their experience and customer focus make them worth considering for your precious metals needs.

Start small and learn as you go. Buy quality over quantity. A few genuine pieces beat a pile of questionable items. Keep records of your purchases. Store your metals securely. Think long-term.

Whether you buy gold bullion bars online or buy rare silver coins online, you’re making a tangible investment. These metals sit in your hand. They’re real assets that don’t depend on corporate performance or government promises. That physical reality provides comfort many investors value.

The precious metals market welcomes new participants. You don’t need to be wealthy to start. You just need knowledge, patience, and a reliable dealer. Take your first step today and begin building wealth that lasts.